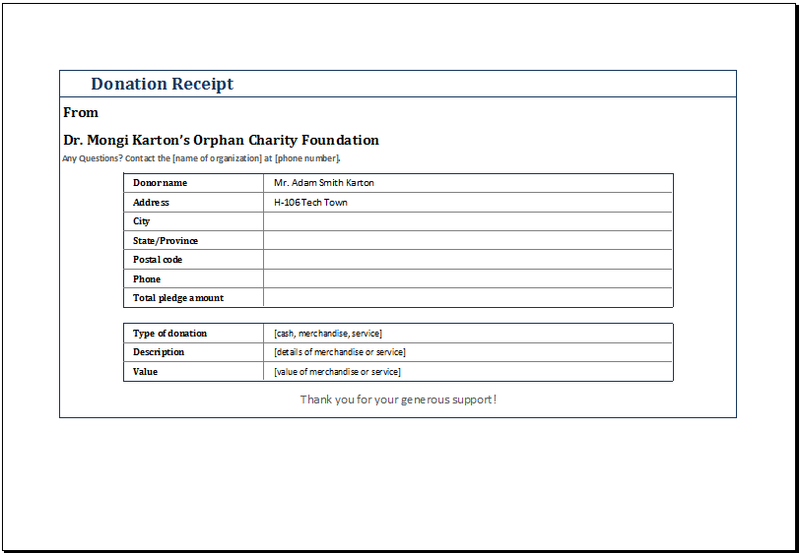

Receipt For Donation

The text receipt should include all basic information such as your organizations name the amount of the. Your donation receipt should look official so create a template on your nonprofits letterhead.

Nonprofit Donation Receipts Everything You Need To Know

The donor should receive a non-profit receipt with a written disclosure of the amount that exceeds the fair market amount of the goods or services given in return.

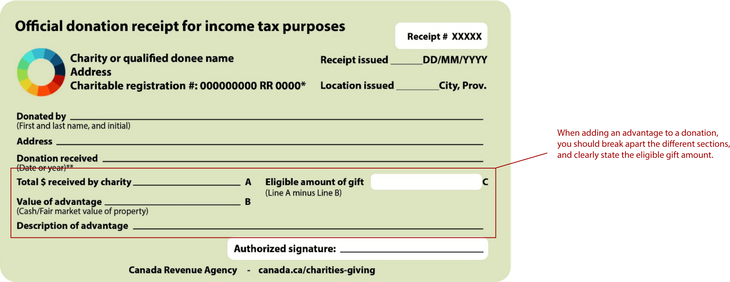

. Non-cashin kind donation receipt with advantage Canada only These donation receipt templates are issued when a donor receives a gift in return for a donation of items such as clothes food etc. A charitable donation receipt is a letter email message or receipt form notifying a donor that their gift has been received. Its a vital document thats needed for donors to write off their.

Sending out donation receipts is another way that organizations can keep track of their individual supporters donation histories. Select a Sample Template to Tweak. You should include this information to make your document useful and official.

Each template is premade so you never need to work at the very start. Failure to send a receipt can result in a penalty of 10 per contribution up to 5000 for each specific campaign. 501 c 3 charity donation receipt is written by the charity organization upon receiving contributions worth 250 and above.

Use our free template to create a simple quick and professional receipt. Any gift over 250 must be recognized with a receipt. Personalization using merge tags which automatically pull a donors name organization info and transaction info into the receipt.

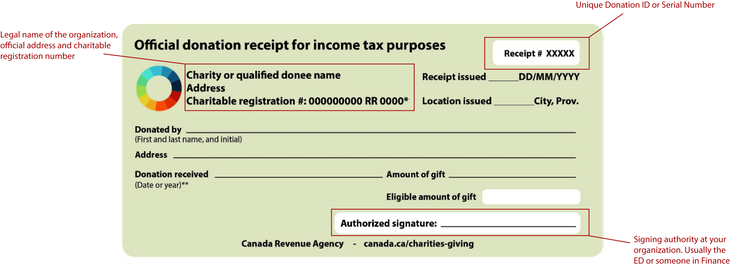

Create Legally Binding e-Signatures on Any Device. Goodwill SCWIs tax ID number is 39-114-7571. XXX The serial number of the receipt.

It acknowledges that a gift was made to you and that the receipt contains the information required under the Income Tax Regulations. When a donor requests a donation receipt. 501c3 Donation Receipt Template.

Donors get this receipt as official proof of the contributions theyve made throughout the year. Moreover you can only issue a donation receipt under the name of the individual who made the donation. Donations less than 250 do not need a 501c3 donation receipt to be deducted in tax.

Text Receipt for Donations. Start exploring our sample donation receipt templates now until you can choose your preferred template to work with. This offers an immediate response and you can provide a link for the donor to download a more detailed donation receipt for their records.

Sending a text receipt is another way thank donors for their support. Ad Our site shows when receipts are sent viewed by your customer and accepted or declined. Thank you for your donation.

Please keep your receipt for tax purposes and note that Goodwill SCWI does not retain a copy. Rest assured framing a donation receipt gets easier with professionally made templates. No goods or services were exchanged for.

The 501c3 donation receipt is customarily sufficient proof of a donors eligibility to the IRS. Ad 1 Legal Form library PDF editor e-sign platform form builder solution in a single app. The receipt is important to the donor who gives out cash vehicle or personal property and wishes to have a tax deduction on the donation.

PdfFiller allows users to edit sign fill and share all type of documents online. Official donation receipt for income tax purposes A statement that identifies the form as an official donation receipt for income tax purposes. A donation receipt template should comply with particular requirements when it comes to the information it contains.

This could be due to hisher companys reasons or. Include stock text with fill. When writing an automatic donation receipt for a 501c3 organization you should include.

This helps the donor to know hisher total tax deduction for the charity contribution. A sincere thank you to your donor. The cost of the gift the donor receives must be subtracted to calculate the taxable amount.

Please note that it is the responsibility of the donor to determine fair market value of the items donated. A specific description of how their gift will make an impact for this particular. Create a template on your nonprofits letterhead.

Cash Donation Receipt Template With Advantage Canada. A Donation Receipt sometimes called a tax receipt is a formal written statement from a qualifying nonprofit which acknowledges they received a donors donation. Legal Forms with e-Signature solution.

Often a goodwill donation receipt is presented as a letter or an email which is given or sent to the benefactor after the donation has been received. Ad Purple Heart Tax Receipt More Fillable Forms Register and Subscribe Now. The IRS requires a donation receipt if the donation made is more than 250 regardless of whether the donation was in cash bank transfer or credit card.

Charitable donation receipts contain any and all information regarding the gift donor name organization name gift amount gift type etc. To place it simply donation receipts are concrete proof or evidence that a benefactor had made a contribution whether in-kind or monetary to a group association or organization.

5 Donation Receipt Templates Free To Use For Any Charitable Gift Lovetoknow

Free Donation Receipt Templates Samples Word Pdf Eforms

Nonprofit Donation Receipts Everything You Need To Know

Donation Receipt Template Pdf Templates Jotform

Donation Receipt Template Download Printable Pdf Templateroller

Free Goodwill Donation Receipt Template Pdf Eforms